Condo Insurance in and around Borger

Looking for outstanding condo unitowners insurance in Borger?

Condo insurance that helps you check all the boxes

Welcome Home, Condo Owners

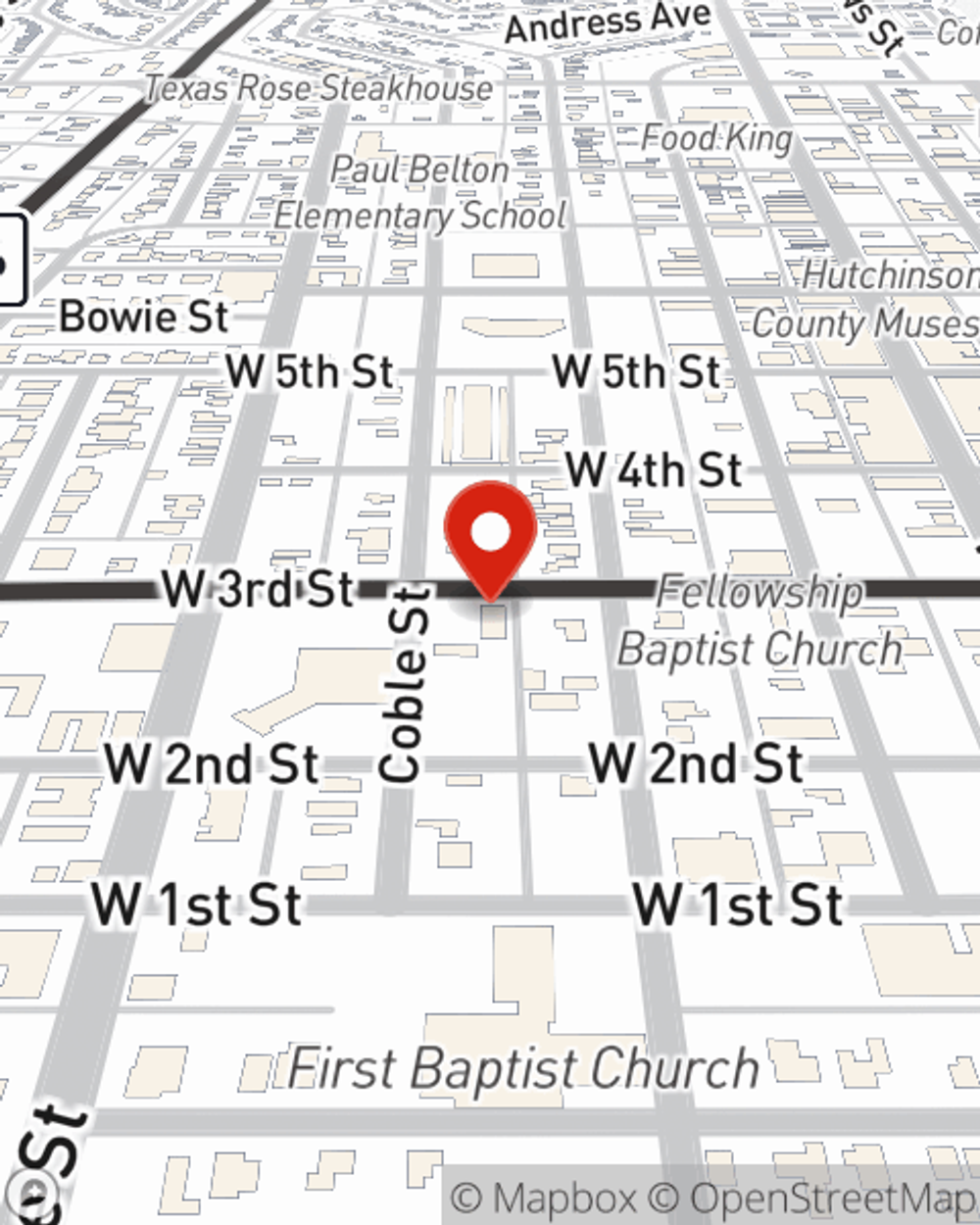

You have plenty of options when it comes to choosing a condominium unitowners insurance provider in Borger. Sorting through savings options and providers is a lot to deal with. But if you want surprisingly great priced condo unitowners insurance, choose State Farm for covering your condo and personal belongings. Your friends and neighbors in Borger enjoy remarkable value and hassle-free service by working with State Farm Agent Russ Glaze. That’s because Russ Glaze can walk you through the whole insurance process, step by step, to help ensure you have coverage for your condo as well as jewelry, linens, electronics, mementos, and more!

Looking for outstanding condo unitowners insurance in Borger?

Condo insurance that helps you check all the boxes

State Farm Can Insure Your Condominium, Too

It's no secret that life is full of surprises, which is all the more reason to be prepared for the unexpected with condo unitowners insurance. This can include instances of liability or covered damage to your condo unit from an ice storm, water damage or a windstorm.

As a value-driven provider of condo unitowners insurance in Borger, TX, State Farm aims to keep your home protected. Call State Farm agent Russ Glaze today for a free quote on a condo unitowners policy.

Have More Questions About Condo Unitowners Insurance?

Call Russ at (806) 273-2601 or visit our FAQ page.

Simple Insights®

Appliance maintenance to-dos for your home

Appliance maintenance to-dos for your home

Regular upkeep of all of your home’s appliances and big systems is a must-do that ensures these investments work well and have long, productive lives.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

Simple Insights®

Appliance maintenance to-dos for your home

Appliance maintenance to-dos for your home

Regular upkeep of all of your home’s appliances and big systems is a must-do that ensures these investments work well and have long, productive lives.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.